Geothermal News

-

Turkey global leader in new geothermal capacity in 2018, Croatia sixth

-

Razor Energy Receives Funding for Geothermal Power Project

-

ENERGY DEPT: GEOTHERMAL POWER HAS “ENORMOUS UNTAPPED POTENTIAL”

-

Turkey global leader in adding new geothermal capacity in 2018

-

US report finds the sky is the limit for geothermal energy beneath us

-

Celebrating World Bathing Day – how a geothermal well started a baby boom in Iceland

- 30% of total system cost in 2022 through 2032

- 26% of total system cost in 2033

- 22% of total system cost in 2034

- No limit to credit amount

- Can be used to offset alternative minimum tax (AMT)

- Can be used in more than one year

- Can be combined with solar and wind tax credits

- Can be combined with energy efficiency upgrade credits

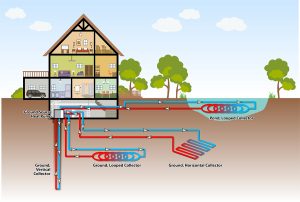

What’s Eligible: Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets ENERGY STAR requirements at the time of installation is eligible for the tax credit. Covered expenditures include labor for onsite preparation, assembly, or original system installation and for piping or wiring to connect a system to the home. The structure must be located in the United States and used as a residence by the taxpayer, although primary residency isn’t required. In fact, if geothermal is installed in more than one home, there’s no limitation on the number of times the credit can be claimed.

What’s Not: The credit can’t be claimed for spending on equipment used solely for hot tub or pool conditioning, nor on previously used equipment. Rental home installations also cannot be claimed. As of November 2013, electric strip heat and ductwork distribution systems are no longer included in the tax credit calculation.

How to Claim the Credit: Use IRS Form 5695 to claim the Residential Energy Efficient Property Credit, and there’s no limit on the credit amount. The tax credit can be used to offset both regular income taxes and alternative minimum taxes (AMT). If the federal tax credit exceeds tax liability, the excess amount may be carried forward into future years. Spending on geothermal heat pump property adds to your home’s cost basis but also must be reduced by the amount of the tax credit received.

Learn more about offers and rebates.